As the healthcare industry emerges from the pandemic, it has gained a renewed appreciation for the important role the home can play as a site of care, even for acutely ill patients historically requiring care within the 4 walls of a hospital. While hospital-at-home is by no means a new model of care, until the Centers for Medicare and Medicaid Services (CMS) launched its Acute Hospital Care at Home waiver program in November 2020, a vast majority of health systems didn’t have hospital at home on their radars.

Given the variety of clinical, experiential, and financial benefits of hospital at home, its growth in the coming years is highly probable. Considering the sizeable patient population that could potentially benefit from acute care at home (up to 25%, though estimates vary), a growing number of start-ups, physician groups, post-acute providers, and other adjacent players are critically evaluating how they can capture a part of this nascent, high-potential market.

It’s no wonder hospital at home is a hot topic across health system executive suites and board rooms. But while health system leadership contemplate what role patients’ homes should play in their future clinical network portfolio, few have made it a clear priority. For most, hospital at home and other home-based care models remain an open question. As a result, they are choosing to wait and see how the market unfolds before they seriously evaluate the business case.

For leaders seeking clarity on the potential strategic value of hospital at home, a familiar analog offers some interesting lessons: the evolution of the ambulatory surgery center (ASC) sector. Early on, health systems largely chose to dismiss ASCs, likely underestimating the direct strategic threat they posed to a major revenue driver for their enterprise. This created a window of opportunity for industrious surgeons and private capital to exploit an unmet market need. A similar scenario could very well unfold with home-based acute care for health systems lacking the capability.

While some health system executives may argue there was not a material strategic or financial cost to their “wait-and-see” mentality with ASCs, we anticipate different risks with hospital at home. This, in part, is because it takes significant time to achieve stakeholder alignment and buy-in for the business plan and care model, implement a program and mature capabilities, and achieve sufficient scale to realize investment returns.

The following discrete differences between the rise of ASCs and the impending rise of hospital at home suggest different market forces are at play.

The Rise of ASCs Provides 3 Key Learnings

The early growth of ASCs seemingly posed little threat to many health systems’ core acute care and hospital outpatient department (HOPD) business. As such, many health systems had a “wait-and-see” mentality. This created an environment for new entrants to establish a strong foothold. As clinical use cases and allowable procedures expanded in the ambulatory setting, incumbent systems found themselves with a new class of mature competitors targeting attractive profit pools that had previously helped drive many hospitals’ financial engines.

If health systems could go back in time and rethink their ASC strategy, would they? Health systems are now faced with a similar question at the front end of the hospital at home movement. Consider 3 relevant dynamics:

1. In their infancy, ASCs had few evidence-based clinical use cases, whereas hospital at home can already reach a broad patient population.

The ASC addressable market was initially narrow. Over time, innovation and technology advancements enabled substantial growth. In 1995, 80% of surgeries were performed in hospitals on an inpatient (IP) basis, and more than 90% of outpatient (OP) surgeries were performed in hospital outpatient departments (HOPD).1 Today, OP surgeries outnumber IP cases. Over the past 10 years, ASCs have overtaken HOPDs, now contributing more than 60% of OP cases.1 Already valued at more than $35 billion, the total U.S. ASC market is forecasted to grow more than 6% per year through 2028.2

Lower costs, increasing demand for minimally invasive surgeries, technological advancements, and greater surgeon autonomy are some of the factors responsible for ASC market growth. As ASC capabilities continue to advance and unlock new procedure types that can safely be performed absent adjacent acute-level resources, further sector growth is almost inevitable.

In contrast, hospital at home care models already have a large—and growing—body of clinical evidence across multiple clinical conditions, as well as several other well-documented benefits.3 With this evidence, the healthcare industry is more confident in the utility of hospital at home models compared to ASCs when they first emerged.

2. Traditional reimbursement models disincentivized health systems from pursuing ASCs, but growing evidence demonstrates that under the right circumstances, hospital-at-home can be economically favorable for health systems.

With HOPD reimbursement often exceeding that of ASCs by more than 50%, health system executives were understandably hesitant to cannibalize a major source of revenue. But that cleared a path for enterprising investors to disrupt and develop an adjacent market that has now become a competitive force, evidenced by the fact that more than 90% of new ASCs are for-profit.4

Today, hospitals have full or partial ownership in only 20% of ASCs, while 90% of ASCs in the U.S. have at least some physician ownership—with nearly two-thirds solely owned by physicians.5 Looking ahead, hospitals are likely to drive a disproportionate share of ASC segment expansion due to the push toward site-neutral payments, changing patient preferences, and continued technology advancements. From a financial standpoint, perhaps delaying entry into the ASC segment was prudent for some health systems. That said, many health systems are now playing catch-up to avoid further disintermediation.

In contrast, under the right circumstances, scaled hospital at home programs have several realizable financial benefits, even in a fee-for-service environment. These models can improve a system’s bottom line by reducing direct costs per discharge, improving length of stay within physical assets, freeing up capacity for higher-margin cases, and unlocking future capital avoidance, among other value drivers.6 Moreover, acute care at home will be an important capability for the continued transition toward value-based care, while also enabling more flexible and resilient acute-care capacity.

Hospital at home has all the right ingredients for both government and private payers to support these models over time. CMS's recent waiver extension, which sustains the regulatory and economic framework to accommodate home-based acute care, represents a positive signal to the market that Congress acknowledges the promise of hospital at home and its future role in the care delivery ecosystem. As the hospital at home care model continues to gain momentum, health systems that choose not to build or partner for this capability will likely face similar disruptive conditions they experienced with ASCs.

3. ASCs did not present a compelling first-mover advantage for health systems, while hospital at home does.

ASC business models are rather straightforward, do not require significant capital, and can succeed within traditional reimbursement structures. Beyond possible regulatory considerations (e.g., CON laws), health systems do not face significant barriers to entry. The hospital at home competency, on the other hand, takes time to nurture and mature.

Hospital at home operating models necessitate complex orchestration of clinical and ancillary services, updates to policies and procedures, deliberate and ongoing change management to align stakeholders, and several other requirements to succeed. Furthermore, the hospital at home business model is scale-dependent for long-term viability. Early adopters are likely to achieve differentiated capabilities long before the “wait-and-see” segment is able to mature their own capabilities. Early adopters also have an opportunity to position themselves as a provider of choice for both the payer partners that can share in cost savings as well as patients attracted to receiving care in the comfort of their homes.

ASCs gained traction for several reasons, including benefits to patients (e.g., shorter stay, more intimate experience, and reduced out-of-pocket cost), improved clinical outcomes (e.g., faster recovery, lower infection, and reduced readmission rate), and reduced costs (e.g., lower fixed cost, more efficient ORs). These value drivers are strikingly similar for hospital at home.

The Rise of the Home as a Site of Care Is Here

Surgical site-of-care transitions didn’t happen overnight. They started as a slow, and then accelerated, march. Many health systems chose not to invest ahead of the ASC market’s maturation, largely due to their hospital-centric economic models. This choice enabled well-capitalized new entrants and innovative provider groups to increasingly cannibalize IP and HOPD volumes, while incumbent hospitals quite literally watched their surgeries walk out the door.

In the same vein, the shift to the home as a site of care has already begun and will accelerate over the next decade. This shift will occur whether health systems drive this change or—as with ASCs—new entrants innovate around them.

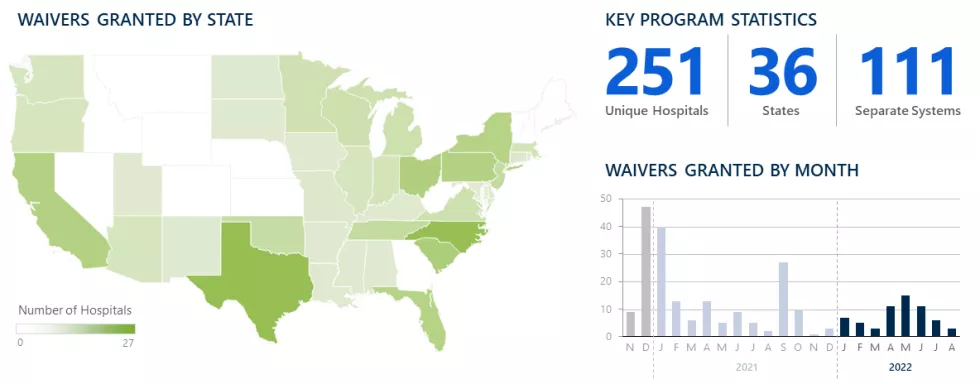

So why, then, have just 5% of hospitals in America sought approval for the CMS Acute Hospital Care at Home waiver?7 And of those, why have even fewer invested to grow their programs to material scale? Prior to the waiver, there were only a small number of hospital at home programs across the U.S. Since the waiver was introduced, 251 hospitals have received approval (as of August 23, 2022), though we estimate only about half of approved hospitals have officially launched their programs.

National Distribution of Hospitals Granted CMS Waivers7

As of August 23, 2022

That said, the industry’s interest appears to be increasing. According to our 2022 health system survey, 4 in 5 health systems surveyed have plans for hospital at home—although some still have not defined their vision (17%) or were still in planning stages (42%).

Hospital at home pioneer Bruce Leff, MD, has succinctly summarized why health systems are getting more serious about this new capability: “One day, hospitals will just be ERs, intensive care units, and operating rooms. Everyone else will be treated at home.” Dr. Leff also predicts, “It is now completely within our reach to create a full, home-based care continuum.”8

The “Wait-and-See” Approach Poses Risks

If transitions in surgical sites of care prove to be an analog for the rise of hospital at home, it is the early adopters that may have the most to gain. Unlike ambulatory surgery, in which only a small segment of patients were initially eligible to receive care in an ASC, hospital at home already casts a wide net of eligible clinical conditions. Unlike the early days of ASCs, hospital at home has been studied over many years to validate its benefits—including cost, quality, and outcomes. Forward-looking health systems that wish to shape the future of acute care—rather than be shaped by it—should seek to align their longer-term strategy with current and medium-term operations to build the necessary infrastructure that will proactively meet the evolving expectations of patients, providers, and payers.

Every health system should evaluate the role hospital at home could play within their service portfolio. Even if an organization’s strategic evaluation of hospital at home determines it is not the right time to move forward with a program, there is value in understanding what must be true to proceed. Such an evaluation will give leadership a context by which to monitor the market’s evolution and reconsider their hospital at home strategy over time. Simply waiting to see how this plays out may put health systems at a disadvantage as other market players carve out yet another segment of their legacy business.

© 2024 The Chartis Group, LLC. All rights reserved. This content draws on the research and experience of Chartis consultants and other sources. It is for general information purposes only and should not be used as a substitute for consultation with professional advisors.