This report is an updated version based on the corrected data set CMS released in March 2023.*

Tailwinds that have propelled Medicare Advantage popularity persist as we look at the 2023 plan year. Despite some tumult in the market—from changes to the Risk Adjustment Data Validation (RADV) program, actions from the Centers for Medicare and Medicaid Services (CMS) for select plans, and some headline-grabbing retreats from start-up plans—this year saw record enrollment and pushed program penetration past 48%. This year’s growth increased overall Medicare Advantage program participation by 9.5% and added 2.7 million beneficiaries. A total of 30.7 million beneficiaries are now enrolled in a Medicare Advantage plan.

The Medicare Advantage market features a complex and continuously changing landscape of competition for eligible beneficiaries. The competitive complexity and changes have far-reaching implications not only for the health plans that serve these members directly but also for healthcare services organizations (such as value-based primary care practices) whose businesses are built on serving this important segment.

Notably, this year:

- The pace of Medicare Advantage growth continues. This year, Medicare Advantage enrollment grew by a record 2.7 million. This is remarkable growth in itself, but it is even more impressive given the continued deterioration of Original Medicare. This year, Original Medicare again contracted by 1.3 million. Since 2019, Medicare as a whole has added 5.1 million beneficiaries, and Original Medicare itself has shrunk by 4 million. Special Needs Plans (SNP) enrollment accounted for one-third of total market growth. SNP enrollment is up 20% from 2022, driven by considerable D-SNP enrollment gains.

- Blues plans may be regaining their footing, but United leads growth with record enrollment. For the first time in many years, nonprofit Blues plans1 notched a market share gain of 0.1 percentage point. While modest, this increase sits in stark contrast to remaining nonprofit plans, which saw a 1.1 percentage point share decline, continuing prior years’ losses. Conversely, for-profit United accounted for a staggering 44% of all new enrollment. Humana accounted for 23% of all new enrollment, meaning the 2 health plans combined represent 2 in 3 new enrollees nationally.

- Start-up plans continue to establish a meaningful market presence. Overall, start-up plans participating in Medicare Advantage that we track notched nearly 22% growth, or 100,000 lives. Devoted Health alone accounted for nearly two-thirds of this growth. The start-up cohort’s growth has brought its cumulative market share up to 1.8% despite individually neither having more than 0.5% of the market.

- Plan options have reached an all-time high, but health plan competition is limited. Plan options for consumers have been growing more than 11% per year. This year, the average member had access to 44 different plan options, up from 24 in 2019 (a growth of 84%). Despite this, at the county level, plan-level competition in the market is sparse. Nearly 85% of counties are considered “highly concentrated.”

- Quality performance correlates to enrollment performance. 73% of Medicare Advantage beneficiaries are enrolled in health plans receiving 4+ stars this year, down from 89% the year prior. Health plans that saw their quality rating increase realized 13.8% enrollment gains, despite only 6.7% growth for health plans that saw their ratings decline this year.

In this year’s study, we focus again on the competitive pressures facing nonprofit and Blues plans as we continue to see share erosion among these health plans. In addition, we discuss several compelling themes that each point to an increasingly nuanced and evolving competitive landscape for covering seniors. The market for Medicare Advantage continues to grow in both size and complexity.

The Market Continues to Grow, Led by For-Profit Insurers

A Record 30.7 Million Individuals Are Now Enrolled in Medicare Advantage

Penetration continues to grow, with 48% of all Medicare beneficiaries now enrolled in a Medicare Advantage product. This reflects growth of 2.7 million total beneficiaries since 2022.

Medicare Advantage Growth and Penetration Changes by Year

This Year Demonstrates a Continuation of Prior Years’ Growth in Medicare Advantage Enrollment

Original Medicare continues to lose enrollment at a rapid pace. This year, Original Medicare enrollment shrunk again—by 1.3 million—while Medicare Advantage enrollment saw its highest absolute growth yet, adding 2.7 million members. The net effect of these dynamics meant an additional 1.3 million total Medicare beneficiaries, in-line with prior years’ figures (not accounting for the impact of COVID-19 on the Medicare population). The shift is stark—while Medicare enrollment continues to progress at an even pace, the performance of Medicare Advantage is coming at Original Medicare’s expense. Growth in the overall market is accreting to Medicare Advantage plans alongside a cannibalization of Original Medicare enrollment into Medicare Advantage.

Annual Enrollment Growth Differences Between Original Medicare and Medicare Advantage

For-Profit Plans Continue to Capture Greater Market Share at the Expense of Nonprofit Plans

This year, for-profit insurers account for 72.9% of all Medicare Advantage enrollment, up from 71.8% the year prior and 67.9% in 2019. This marks a 5.0 percentage point share increase over that period, and annual growth rate of 11.2%. Meanwhile, nonprofit plans continue to see share declines, although their enrollment is still growing. Notably, this year, Blues plans notched a 0.1 percentage point share gain, their first share gain in many years.

Share of Enrollment by Plan Cohort by Year

United and Humana Lead the Market’s Growth, with Regional Blues Showing Momentum

The market grew by 2.7 million beneficiaries this year. 84% of that growth accrued to for-profit plans, 10.5% to Blues plans, and 5.4% to non-Blue nonprofit plans. This follows trends we’ve seen in years past, but 2 important competitive shifts stand out this year.

First, United alone accounts for 44% of the market growth, and Humana accounts for 21%. Together, they account for nearly 2 in 3 new enrollees. While these 2 health plans often led in years past, this increase reflects considerably more concentrated performance. Second, among the 2 nonprofit cohorts (Blues and other nonprofits), Blues took the lion’s share of growth, led by regional Blues plans such as Highmark2 and Health Care Services Corporation (HCSC). In years past, this growth had been more evenly shared between nonprofits and Blues plans, but this year appears to be accruing primarily to the Blues.

Distribution of 2023 Enrollment Growth by Plan Cohort

As shown in the table below, leading for-profit plans continue to aggregate enrollment. Strong enrollment gains this year added 1.4% market share for United and 0.3% for Humana. CVS (Aetna) and Elevance (Anthem) maintained their share. Centene saw enrollment decline 2.5% overall, which resulted in a 0.7% market share decline this year. Together, the 10 largest for-profit plans account for 70.6% of the Medicare Advantage enrollment nationally, with the top 5 plans alone accounting for 67.1%.

Enrollment and Share Changes for the Top 10 Largest For-Profit Medicare Advantage Plans

Special Needs Plan Enrollment Grew 20%

SNPs had a record year, growing by more than 900,000 enrollees to 5.4 million in total. This market now represents 18% of all Medicare Advantage enrollment. Additionally, this year’s growth in SNPs accounted for approximately 34% of all Medicare Advantage enrollment growth, further underscoring how important this population is to the market. Enrollment accelerated to 20% over 2022, from an average of 17% per year since 2019. D-SNPs continue to see rapid enrollment gains, growing 21%, while C-SNP and I-SNP plans each grew by 11%.

SNP Enrollment Continues to Grow at a Rapid Pace

Competitively, United and CVS (Aetna) gained meaningful market share points, while nonprofit Healthfirst fell to the sixth largest plan for SNP enrollment. The top 5 plans for SNP enrollment now account for 78% of all enrollment as these plans shift their focus to this previously overlooked segment.

SNP GROWTH ACCRETES TO SELECT FEW PLANS

At Every Level, the Market Continues to Evolve as it Grows

22 States Now Have 50% or More of Their Enrollment in Medicare Advantage

State-level dynamics continue to play out differently across the country. 22 states now have 50% or more of their Medicare enrollment in a Medicare Advantage plan, up from 11 last year. In keeping with years past, under-penetrated states (those with approximately 20% to 30% penetration) saw the greatest growth rates, followed by mid single-digit growth for states that had higher rates of adoption going into the year.

Existing penetration rates and the rate at which a state’s Medicare Advantage enrollment is growing are 2 key metrics that provide insight into a state’s market maturity. The map below shows the 2023 Medicare Advantage penetration rate and the year-over-year growth in enrollment for each state. Of note, 14 states have both high penetration and high annual growth, making them attractive markets for businesses oriented toward serving Medicare Advantage and eligible individuals.

Medicare Advantage Penetration and Growth Rates by State

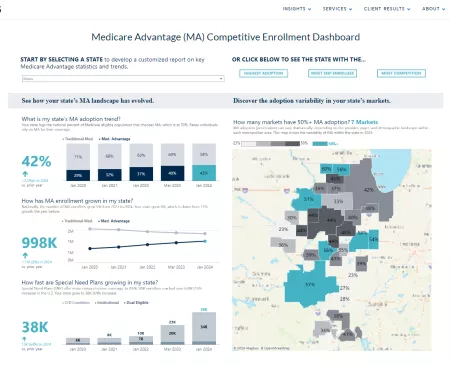

Explore Enrollment Trends and Competitive Dynamics by State

Our Medicare Advantage Competitive Enrollment Dashboard lets you explore the meaningful dynamics unfolding in each state.

Devoted Health Led Start-Up Plans, with Record Enrollment Gains

Start-up plans tracked in our index now account for 1.8% of all Medicare Advantage enrollment nationally, up from 1.1% in 2019.3, 4 This marks a gain of 0.2 percentage point in share, or 21.7% growth over the prior year, to nearly 560,000 total members. This growth was led principally by Devoted Health, which alone added nearly 59,000 members of the cohort’s 100,000 enrollment gain. Some leading start-up plans lagged overall market growth. For plans such as Bright Health, Clover Health, and Oscar Health, this performance reflects planned market exits and retrenchment for the 2023 plan year.

Start-Up Plan Market Share and Enrollment Growth

Medicare Advantage Plan Options for Consumers Have Reached an All-Time High

This year also marked yet another record year in the availability of plan options. Nationwide, Medicare Advantage enrollees had access to nearly 4,100 plan options, and SNP enrollees had nearly 1,300 options. Plan choices have grown 11% per year, outpacing enrollment growth, as plans have sought to develop increasingly creative and attractive product offerings for their customers.

Total Number of Unique Plan Options Available

Of the 4,100 plan options available nationally, PPOs make up approximately 41% of all Medicare Advantage plans available to consumers this year, up from 32% in 2019. This reflects a growing trend of health plans marketing products with more choice to consumers to encourage the shift from Original Medicare to Medicare Advantage.

Share of PPOs and HMOs Among Plan Options Nationally

Finally, at a local level, plan options have never been greater. The average individual in a county has access to 44 different plan options, up from 24 in 2019 (growth of 84%). Measured across a state, that number rose to 168 this year. Between 2022 and 2023, only 9% of counties saw a decline in the number of plan options, while 91% maintained or grew the plans available to enrollees. From local to national markets, consumer choice of plan has never been greater.

Plan Option Availability to the Average Medicare-Eligible Individual

Market Concentration Has Increased

The Herfindahl-Hirschman Index (HHI) is a common metric that regulators use to assess the competitive environment of a given market. We applied the same test in our analysis, not to make a regulatory statement around market concentration, but simply to understand the competitiveness of Medicare Advantage markets nationally. We find that, in 2023, many of the top 10 states are more concentrated than the prior year. This is a reversal of prior years’ findings, which suggested that plan competition had improved modestly in the top 10 states.

HHI Trend for the 10 States with the Top 2023 Enrollment

At a county level, we find high levels of market concentration, with approximately 91% of rural counties and 75% of urban counties considered highly concentrated. These figures had been improving modestly in recent years but ticked up this year for urban counties, likely in response to our earlier findings around historic enrollment growth concentration this year.

Market Concentration by Urban and Rural Counties

Quality Score Changes Materially Impacted Enrollment Performance

In October 2022, CMS released its star ratings for the 2023 plan year. As many anticipated, the score changes were unfavorable for plans due to the removal of COVID-19 adjustments. Overall, quality scores declined nationwide by 0.31 stars for the average plan and 0.15 stars weighted by 2023 enrollment. This performance has meaningful implications for the economics of these programs, as program revenue and ability to invest in member benefits are tied to quality performance. This year, we saw 73% of Medicare Advantage enrollment in plans with 4+ stars, down 16 percentage points from 89% in 2022. Generally, scores returned to performance more akin to pre-pandemic, though the deviations increased considerably. On the positive side, 22% of plans are now 5 stars, compared to approximately 10% before the pandemic. Conversely, 27% of plan enrollment is below 4 stars, compared to approximately 20% before the pandemic.

Enrollment Distribution by Star Rating

For some plans, such as CVS (Aetna) and Centene, quality scores now sit below their pre-pandemic levels. For others, such as Blue Cross Blue Shield Michigan and Highmark Health, they are materially higher than their pre-pandemic levels.

Plan Star Trend by Payer: Top 10 largest plans for 2023

Quality performance scores have a direct correlation with enrollment performance. Contracts with a decline in their star rating had a suppressed enrollment growth of 6.7% in 2023. Meanwhile, contracts with no change in their star ratings saw 9.0% growth, and contracts with an increase in their star ratings saw 13.8% growth. The implications of quality performance on growth are meaningful. There are many explanations for why this might be, including consumer selection preference and greater marketing opportunities. Accordingly, these findings (coupled with the shifting concentration of star ratings) merit further analysis to understand the leading factors and market-specific nuances to this important development.

MEDICARE ADVANTAGE ENROLLMENT BY STAR RATING CHANGE

Implications for the Market

Medicare Advantage growth persists, driven by aging demographics and the continued attractiveness of the program among consumers compared to Original Medicare. While we anticipate this trend to continue broadly for the years to come, 2023 marked several very important shifts that have implications for healthcare organizations, including:

- The market is growing rapidly and differently. Medicare Advantage continues to grow and continues to do so at the expense of Original Medicare. Despite Medicare Advantage adding 2.7 million new lives overall, Medicare broadly only grew by 1.3 million, implying a significant attrition in Original Medicare. This shift has meaningful implications for health plans and organizations that serve seniors. The “where” and the “how” of generating enrollment by aligning with growth markets become increasingly important and nuanced.

- Accordingly, growth is elusive for many. We saw some encouraging data for the Blues this year, led by Highmark and HCSC’s enrollment gains. However, other nonprofit plans continue to lose meaningful market share. These gains continue to accrete rapidly to for-profit plans, specifically United. The competitive shift here is stark and will have implications for health plans looking to both enter and grow in this space, for organizations that partner with Medicare Advantage plans, and for healthcare providers that participate in their networks. In addition, the shifting rate dynamics this year will further complicate future growth.

- Growth requires an increasingly complex playbook. With plan options for consumers at an all-time high, robust offerings and target-specific go-to-market efforts have never been more important to drive enrollment gains. What’s more, the shock of quality rating changes for 2023 further complicated those efforts as quality performance translated directly to enrollment performance.

These dynamics are material for both health plans that serve this segment and healthcare services organizations that serve these members. There is an ever-growing industry built around Medicare Advantage. The top of the funnel is, of course, Medicare Advantage plans and their ability to attract and enroll members into these products. However, as the industry builds novel businesses and transforms decades-old businesses to support the unique needs of this market, the stakes are high.

Analytic Methodology

Medicare Advantage enrollment, plan, and pricing data from the Centers for Medicare and Medicaid Services (CMS), January 2019 to January 2023. Medicare fee for service (FFS) enrollment data from CMS, January 2019 to January 2023. Includes all Medicare Part C Plans, including Regional PPO and Medicare Cost; limited to 50 states and D.C. Plans categorized as for-profits, Blues, and nonprofit based on analysis by Chartis. For market-level analyses, any counties not part of a CBSA (defined by the U.S. Office of Management and Budget) or that had less than 11 Medicare FFS enrollees were excluded. Special Needs Plan (SNP) data from SNP Comprehensive Reports January 2019 to January 2023. Plan options data from CMS Landscape files 2019 through 2023.

Notes

1 Blues plans referenced include only those that are nonprofit. Anthem and subsidiary plans are classified as for-profit. Nonprofit plans referenced exclude nonprofit Blue-branded plans and subsidiaries.

2 Approximately 45,000 of Highmark enrollment growth reflects the acquisition of remaining stake in Gateway, a nonprofit plan it had partial ownership of in years prior. The transaction closed in 3Q21 but has not been reflected as Highmark enrollment until this year.

3 Essence (Lumeris’ health plan) was added to the start-up health plan index this year, including the plan’s historic enrollment.

4 For purposes of this study, “start-up plans” are those that are or were recently venture-funded or partnered with outside capital to achieve rapid growth through market expansion or partnerships. Some may refer to these organizations as “insuretech.”

Disclaimer

*After initial publication of this report in February 2023, we noticed a material difference between January and February enrollment figures provided by CMS. CMS had then issued guidance that an error in their data collection methodology caused January figures to be understated and that the March release had corrected those understated figures. For the purposes of our report, we are using March 2023 figures to represent 2023 enrollment and calculate annual enrollment changes from prior year(s).

© 2023 The Chartis Group, LLC. All rights reserved. This content draws on the research and experience of Chartis consultants and other sources. It is for general information purposes only and should not be used as a substitute for consultation with professional advisors.